Tax and Assessment

At the April 22, 2025 Council Meeting, Westlock County Council approved the tax rate bylaw for the 2025 tax year.

The Municipal portion of the tax rate decreased by 5% for all property classes.

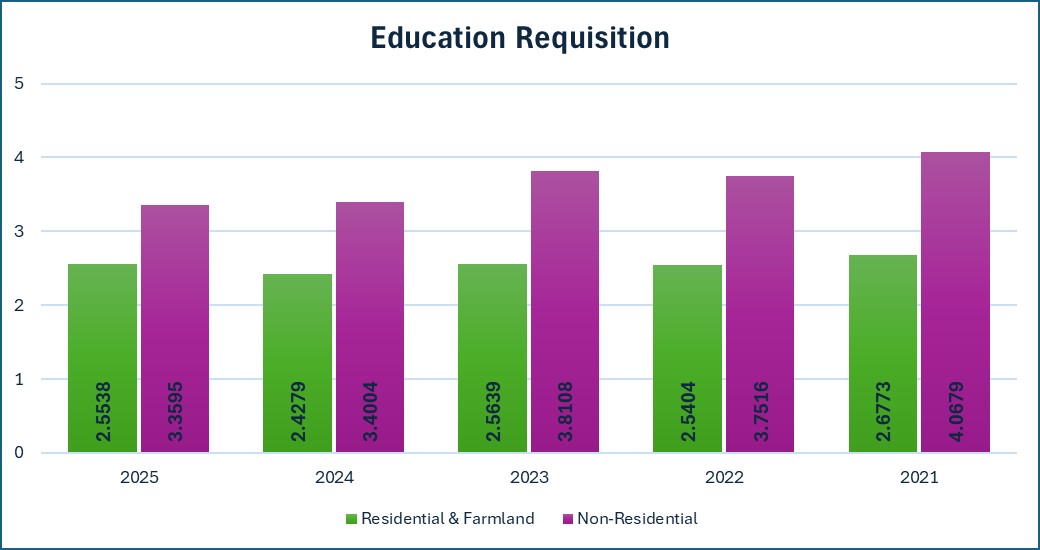

The Alberta School Foundation Fund requisition tax rate increased by 5.2% for residential properties and farmland and decreased 1.2% for non-residential properties.

The Senior’s Housing requisition tax rate decreased by 5.1% for all assessment classes.

An average farm residential property assessed at $264,000 at a combined tax rate of 9.2813 mills will generate a tax levy of $2,450 in 2025 compared to 2024 tax rate of 9.5101 generating tax levy of $2,510.

An average non-residential property assessed at $550,000 with a combined tax rate of 26.2712 mills will generate a tax levy of $14,450 in 2025 compared to 2024 tax rate of 27.5186 generating tax levy of $15,135.

The combined tax rate includes municipal taxes, senior’s housing requisition and school requisition.

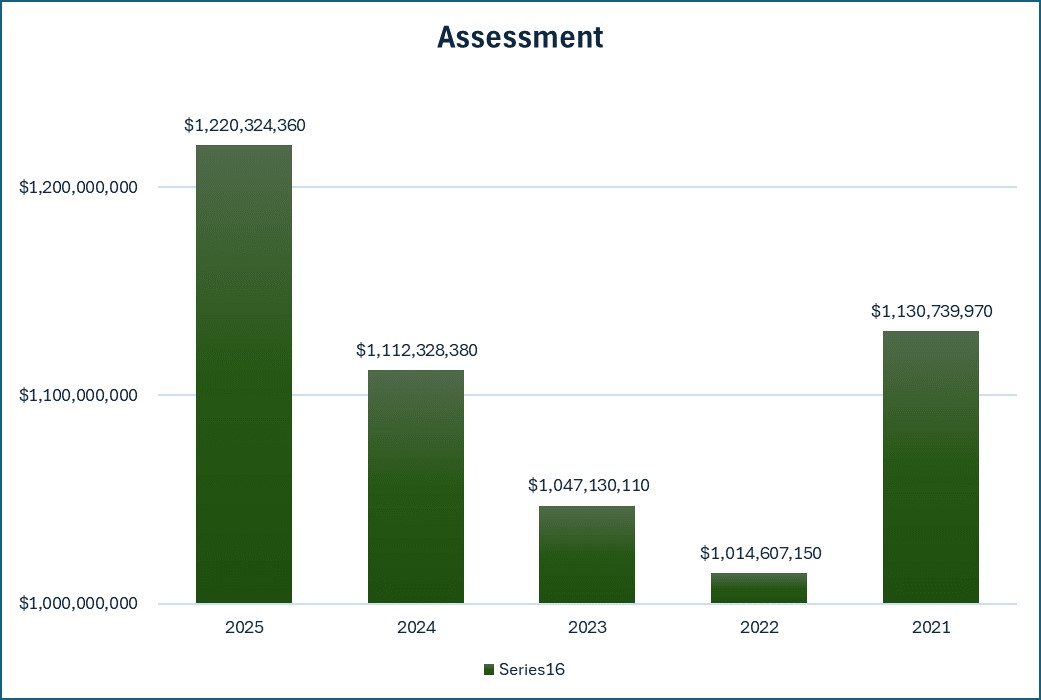

On average, residential property assessments have increased by 10.2% and non-residential property assessments increased 8.4%.

What this means is, that if your property assessment has increased, the overall reduction in tax rate may not translate into a reduced tax levy.

See Your Tax Dollars at Work Chart Here

View the 2025 Assessment Graph here

Your property tax is made up of 3 components, including the Municipal levy, the Education levy and the Seniors Housing levy.

The Tax Rate Bylaw sets tax rates for properties in the municipality. Property taxes are determined by multiplying property assessment values by the tax rates.

Council sets the tax rate based on the required revenue needed to pay for County programs and services. Property assessments and taxes usually change each year due to the requirements of the annual budget and year-to-year changes to property values.

Alberta Education requisition

Each year, Westlock County receives a requisition from the Alberta School Foundation Fund. The County must collect these funds and send them to the Province. The funds support public and separate schools across Alberta. The Provincial Government also sets an education tax rate for municipalities. Westlock County cannot change the requisition amount set by the Province each year.

For more information, view the school support declaration and visit the Education Minister website.

Click here to view the Education Requisition Chart

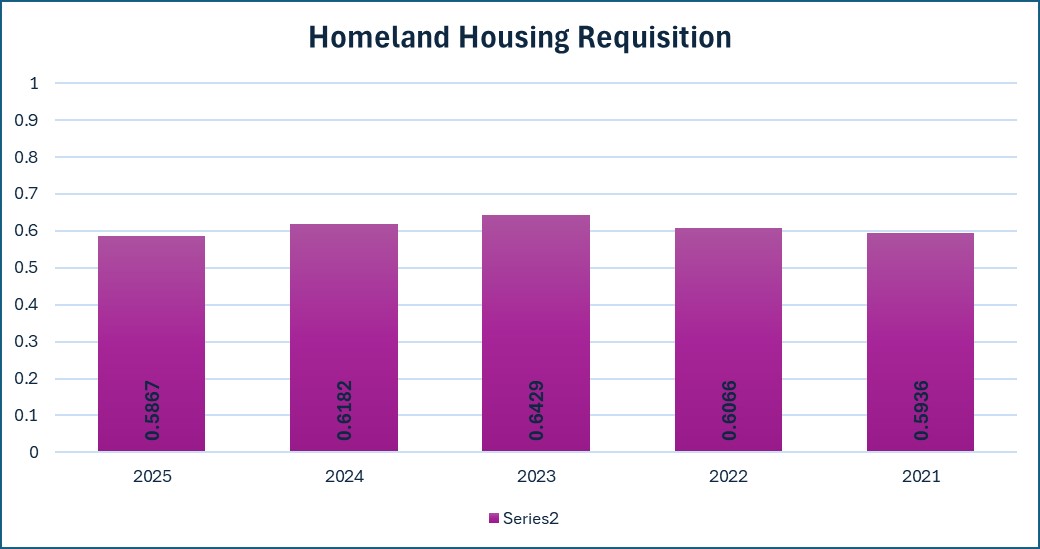

Seniors housing requisition

The County receives a requisition from the Homeland Housing which provides affordable seniors housing. Under the Alberta Housing Act, the municipality collects this amount on behalf of the housing authority to fund the provincially managed service. Westlock County does not set this rate.

View Homeland Housing Requisition Chart Here